The launch of the infrastructure pipeline last month was hailed as a gamechanger for UK construction and investment in private finance for public infrastructure. But Joey Gardiner discovers there are serious fears that it won’t live up to the hype

It is more than a decade since the UK government first published a pipeline of the biggest planned public sector infrastructure and construction projects.

While this was seen primarily as a move designed to give the construction industry the confidence to invest in capacity to meet the projected demand, the released in June said a new would have an additional role: as a prospectus for investors in future public-private partnerships (PPPs).

By giving ‚Äúa confident operational view of the opportunities ahead of us‚ÄĚ, the pipeline would hand investors ‚Äúa reason to invest here in the United Kingdom‚ÄĚ, the strategy said.

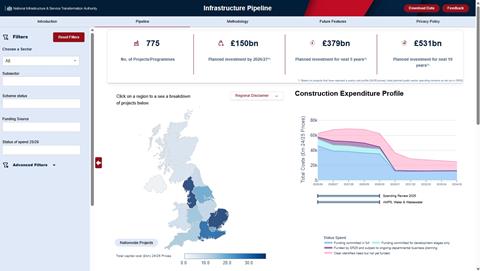

At the pipeline‚Äôs launch last month, a statement from NISTA ‚Äď the Treasury body set up to transform the delivery of major projects and programmes ‚Äď said its ¬£530≤ķ≤‘, 10-year programme of projects would give potential investors ‚Äúthe certainty to plan for the long term‚ÄĚ. And certainly, the pipeline, unveiled as an interactive online tool, was initially welcomed as a huge improvement on the previous incarnations under the last government.

Mark Reynolds, executive chair of construction firm Mace and also co-chair of the Construction Leadership Council, said it would play a critical role in enabling the industry to scale up to deliver 1.5 million new homes and a revitalised national infrastructure. ‚ÄúNISTA‚Äôs new dynamic approach is a major step forward,‚ÄĚ he said.

Likewise, Jon Phillips, chief executive of investor member body the Global Infrastructure Investor Association, said the initiative strengthened the UK‚Äôs appeal, with project investors valuing ‚Äúa clear pipeline of projects that shows the full scope of the UK‚Äôs investment potential‚ÄĚ.

But not everyone is convinced that it is really up to the job of acting as a helpful prospectus for investors ‚Äď at least, not yet. Since launch, as industry experts have looked under the bonnet of the tool, big questions have emerged about the level of detail in the pipeline, and whether it really provides the information that either the supply chain or potential backers of private finance and new PPPs need.

Fully funded

While versions of the infrastructure pipeline have been published since 2013 (before a brief pause last year), commentators do not believe they have thus far had the impact on industry investment that had been hoped for. Zoe Watters, an infrastructure adviser and former PwC partner, says the previous , effectively static analyses of projected departmental spend which did not drill down into project level data, were ignored and ‚Äúnever saw the light of day‚ÄĚ once they were published.

Even , which included detailed Excel sheets including proposed spending on individual projects, suffered from a lack of clarity over the funding status of projects.

What the last government published was essentially a wish list. All of the data on this website is for projects we have committed to, so there’s no question about whether it’s going to happen or not

Darren Jones, Treasury chief secretary

Last month, Treasury chief secretary Darren Jones said the new pipeline was designed to be different. For a start, the data is presented in an interactive way, enabling users to break down the pipeline by sector, or region, or funding route.

But crucially, he claimed, investors and suppliers can have more faith in the information, because every project in it has full financial commitment from central government, as well as funds allocated to it by the relevant spending department.

‚ÄúWhat the last government published was essentially a wish list,‚ÄĚ Jones said. ‚ÄúIt was all the things they wanted to get done at some point in the future, but they had not committed the money or got to a business case stage.

‚ÄúAll of the data on this website is for projects we have committed to, so there is no question about whether it‚Äôs going to happen or not,‚ÄĚ Jones said, arguing that was done in direct response to industry feedback. ‚ÄúThey didn‚Äôt want things in there where we might change our mind.‚ÄĚ

This, he said, explains the discrepancy between the ¬£530≤ķ≤‘ of programmes and projects in the pipeline and the larger (¬£725bn) number in the June infrastructure strategy. The latter, he said, included post-2030 projects that were committed to centrally, but had not yet been through necessary departmental allocations in spending reviews, and therefore did not meet the threshold for inclusion in the pipeline.

One senior construction source said this approach has provided some welcome rigour. ‚ÄúThe credibility of these numbers is significantly more important than getting a really big number that no one believes,‚ÄĚ they said.

‚ÄúWe want the pipeline to be a truly reliable source of market data. This is beginning to look something like a best-in-class pipeline.‚ÄĚ

Status anxiety

Jones‚Äô idea that only fully funded and committed projects earn their place on the pipeline means that contractors and investors would not be able to use it as a guide to the intentions of the government prior to firm decisions having already been taken ‚Äď something some are seeing as a limitation.

For example, the infrastructure strategy identified public sector decarbonisation projects and community and primary health care premises as potential options for a new ‚Äúlimited‚ÄĚ wave of social infrastructure private finance projects ‚Äď with a final decision due at the autumn Budget. However, because this potential ¬£1bn programme has not yet been formally given the green light, there is no mention of them at all in the pipeline ‚Äď so any potential PPP investor wouldn‚Äôt know from the pipeline that the idea exists.

This is just one example. Zoe Watters says: ‚ÄúIt‚Äôs difficult to see how this works as a tool for investors if the potential opportunities for investors are not on there.‚ÄĚ

>> Also read: A good start but there is a lot more work to do: road-testing the national infrastructure pipeline

Another senior construction source says: ‚ÄúWe need more than just the committed projects. This doesn‚Äôt give the sector anything to start working off. We need a statement of intent.‚ÄĚ

In fact, it appears the reality of the pipeline may not be as clear cut as Darren Jones suggests ‚Äď the full data from the pipeline, available via the ‚Äúdownload data‚ÄĚ button on the website, lists the spend status of each project or programme. While for many this is listed as ‚ÄúCommitted ‚Äď fully funded‚ÄĚ, the status for lots of projects remains ‚Äúsubject to business planning‚ÄĚ, and for a few it says nothing at all, or reports as ‚Äúnot yet funded‚ÄĚ. And in fact, the methodology section of the pipeline itself states that the different funding status of projects on the pipeline explicitly means that ‚Äúinclusion of a project on the Pipeline cannot be interpreted as a commitment to build it‚ÄĚ.

Asked to explain the disparity between this and Jones’ comments, a Treasury spokesperson did not offer a formal statement, but explained that the sentiments expressed by the minister reflected the government’s determination to deliver the projects it has committed to - despite the fact further spending decisions around individual projects may evolve over time.

Infrastructure pipeline ‚Äď what it says

Duration: 10 years

Projects and programmes: 775

Value: ¬£530≤ķ≤‘

Value funded by public sector: ¬£285≤ķ≤‘

Value rated as ‚Äúcommitted ‚Äď fully funded‚ÄĚ: ¬£252≤ķ≤‘

NISTA claims the pipeline summarises data on the cost of the ‚Äúmajority of the UK‚Äôs public and private sector major infrastructure projects‚ÄĚ, both for new infrastructure and for maintenance and renewals. Data is at 2024/25 prices.

NISTA said it has worked hard to make the pipeline comprehensive but admitted there were ‚Äúknown gaps in the pipeline‚Äôs coverage that NISTA will seek to address in future updates‚ÄĚ, with some departments having provided data only for 2025/26, with ‚Äúfurther capital expenditure data expected in future iterations of the pipeline once future spend has been confirmed‚ÄĚ. The majority of projects in devolved administrations are also excluded.

In the methodology section of the pipeline website, NISTA added: ‚ÄúThe introduction of four categories which describe the degree of funding commitment has allowed the pipeline to include more projects looking over a longer time horizon than in the past. But this also means that inclusion of a project on the pipeline cannot be interpreted as a commitment to build it.‚ÄĚ

Missing data

Alas, these concerns over what is allowed onto the pipeline is only one issue out of many. There are also fears about big data gaps and inconsistency in how it is provided between different departments and sectors, which critics say is likely to make the pipeline less helpful than hoped.

They point out a series of major lacunas. Firstly, much of the information is simply recorded at a programme, rather than project level ‚Äď meaning that the individual projects that might need private finance, are not detailed. A significant example of this is the ¬£23.3bn New Hospitals Programme, which is listed, but for which no individual projects are mentioned, let alone detailed.

The same goes for the ¬£19.3bn School Rebuilding Programme ‚Äď again no individual projects are mentioned.

Secondly, for many listings key data appears to be missing, such as cost information, or the project sponsor. Thirdly, for those that are recorded as either privately-funded or having joint public/private funding ‚Äď the vast majority of which appear to be uncosted energy projects ‚Äď there is no information given on the specific funding route or structure. In other words, potential private finance investors can get no sense of whether a project is envisaged as being taken forward under a Regulated Asset Base Model, or via Contracts for Difference, or through some other PPP-type structure.

It’s a good start, but this doesn’t really look like the kind of thing that will give the market confidence

Zoe Watters, infrastructure adviser

NISTA has clearly had a challenge in pulling together data from across Whitehall to populate the pipeline, given its launch just weeks after the June spending review which confirmed departmental allocations. It is hardly surprising, then, that the June infrastructure strategy warned the pipeline at launch would be, to an extent, a work in progress ‚Äď particularly with regards to its ability to articulate investment opportunities.

It said the July launch version would be simply the ‚Äúfirst stage in the pipeline‚Äôs development‚ÄĚ and that ‚Äúover time, the pipeline will be expanded and developed to better meet the needs of investors and will include opportunities for private investment‚ÄĚ.

Delivering on this promise is important, commentators say, if government wants the pipeline to become a practical tool for attracting private finance. The senior construction source says: ‚ÄúWhen you have just got programmes not projects, it is not really useful, it won‚Äôt help the industry at all. If they can populate that, then it can become useful ‚Äď but it needs a lot of work.‚ÄĚ

A spokesperson for membership body the Association for Infrastructure Investors in Public Private Partnerships (AIIP), welcomes the progress made with the pipeline, but says it needs to be ‚Äúclearer on what the social infrastructure investment opportunities are, where PPP models will be applied, and the form they will take.‚ÄĚ

For example, the AIIP says the pipeline should be improved by populating it with a project status tracker, by including comprehensive information on the estimated total cost of schemes, by giving details of the procurement approach, by including a brief project history, and by including links to relevant media releases or government publications.

Zoe Watters says: ‚ÄúWe‚Äôve got schemes here with meaningless project names, some with no numbers. It [the pipeline] raises so many questions ‚Äď if schemes are committed, why isn‚Äôt more detail given?

‚ÄúIt‚Äôs a good start, but this doesn‚Äôt really look like the kind of thing that will give the market confidence.‚ÄĚ

Learning

However, this doesn‚Äôt mean the pipeline is necessarily bound to have as little impact as previous efforts. For a start, Darren Jones has already signalled that Nista will formally start including unconfirmed projects in the pipeline ‚Äď as long as that can be done without damaging the integrity of the rest of it. He said: ‚ÄúSome companies are saying to us that it‚Äôd be helpful to have a longer-term view, even if it‚Äôs not committed yet.

Publishing the pipeline can’t be the only thing that happens. Pro-active engagement is what gives confidence to investors

James Stewart, chair, Agilia Infrastructure Partners

‚ÄúSo, one of the pieces of work we‚Äôre taking away is how we maintain that confidence and clarity that everything in the pipeline is committed, but also, for everyone that‚Äôs interested, give you just that slightly longer-term view.‚ÄĚ

In addition, the Treasury told –«Ņ’īę√Ĺ that not only would currently missing privately financed projects in the social sector be brought into the pipeline once their status was confirmed, but also that more data on projects in general will be added once departments have completed post-spending review business planning work.

James Stewart, chair of infrastructure consultant Agilia Infrastructure Partners, says one of the key determiners of success will be whether NISTA is given a further role to talk to the private sector about the opportunities contained in the Pipeline. He says: “Publishing the pipeline can’t be the only thing that happens. When I was the chief executive of [PPP quango] Partnerships UK, one of our jobs was to actively engage the market to talk about the future pipeline of opportunities.

‚ÄúThat pro-active engagement is what gives confidence to investors, it absolutely should be part of the remit of NISTA.‚ÄĚ

Up to date

If the pipeline is going to make any difference to UK investment, the sector wants to see both the information gaps filled in and, vitally, the pipeline kept up to date. NISTA has said the pipeline will be updated every six months, but some feel that as an online ‚Äúlive‚ÄĚ website, there should be no reason it isn‚Äôt simply kept updated constantly as projects are approved.

Zoe Watters says: ‚ÄúIt‚Äôs fair enough if they want to have a major review every six months, but they should be filling in the data gaps all the time with this. We can‚Äôt be waiting six months for more information.‚ÄĚ

To truly solidify investor belief in the pipeline’s deliverability, the government must maintain consistency. Regular, transparent updates to the pipeline are paramount

Meli Duymaz, chief financial officer, Skanska UK

Meli Duymaz, chief financial officer at contractor Skanska UK sees publication of the pipeline is a very welcome step. However, she sees keeping the document live as vital if greater investment is to flow in, as investors need to have confidence in the data.

‚ÄúInconsistencies in pipeline publication and occasional project delays or cancellations have, in the past, eroded confidence,‚ÄĚ she says.

‚ÄúTo truly solidify investor belief in the pipeline‚Äôs deliverability, the government must maintain consistency. Regular, transparent updates to the pipeline are paramount. Any significant changes or delays need clear communication and justification.‚ÄĚ

Whether this will actually happen, and whether the pipeline can deliver on its promise for enabling private finance, remains to be seen.

Funding the Future

–«Ņ’īę√Ĺ‚Äôs Funding the Future campaign seeks to examine fresh ways of attracting and using finance to boost construction projects at a time of constrained public finances.

It will examine options for public-private partnerships that can draw on private capital to pay for large infrastructure projects, schools, prisons, hospitals and housing.

It will also look at existing models for private and public funding and examine how these can be optimised to ensure funding is efficiently spent and leads to more shovels in the ground as Keir Starmer looks to construction to boost flagging economic growth.

Over the next few months we will share learning, consult with industry and collect ideas from readers. This will culminate in a special report to be published at our –«Ņ’īę√Ĺ the Future Live Conference in London on 2 October - click here to book your tickets now.

To share your ideas of new funding models, email carl.brown@assemblemediagroup.co.uk. To find the campaign on social media follow #–«Ņ’īę√Ĺfundfuture.

No comments yet