Tomorrow’s announcement will have huge implications for housing and infrastructure, but defence and health commitments mean cuts will have to fall somewhere. Daniel Gayne reports

It’s almost here. For months now it has been a case of wait and see. Rachel Reeves’ first Budget, which promised greater capital investment while also increasing taxes on business, was met with a mixed reaction within the built environment.

But, since then, there has been a sense among many in the sector that it would not be until the spending review, due to be unveiled by the chancellor tomorrow (Wednesday), that we would discover whether this Labour government really would walk the walk on housing and infrastructure investment.

While last year’s Budget set out plans for where to tax and borrow to fund overall spending levels, the spending review will set out how the Treasury plans to divide up more than £600bn annually between different government departments.

This is the first such review since the pandemic – the last one was undertaken by Rishi Sunak in 2021 – and the government has already made a few key announcements about what will be included. But a large part of the detail will remain under negotiation right up to the wire, as key ministers seek to increase their share of the pie.

Regardless, here are some of the key things to watch out for tomorrow.

Defence and health to eat up most of tax and borrowing gains

Health and defence are expected to be the big winners from the spending review, which could mean cuts in day-to-day spending for departments more relevant to construction. There have been reports that the NHS will receive a £30bn funding boost over a three-year period, which would mean a 2.8% rise in its day-to-day spending.

Meanwhile, the government has already set out a path for defence spending this year. In February, it announced that this would rise to 2.5% of GDP by 2027/28 and stay there, with the March spring statement breaking down how this would be divided between resource and capital spending. Between 2025/26 and 2029/30, the Ministry of Defence’s resource spending limits will grow by 1%, while its capital budget will increase by 6.8%.

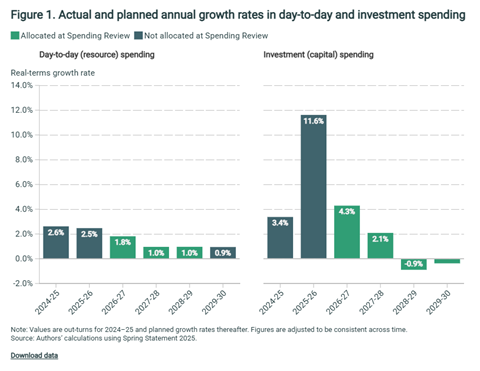

On day-to-day spending, Reeves had already set herself a relatively constrained envelope, with spending growth rates to fall over the course of the review period. If the reported plans for a big boost to health spending – which already has by far the biggest resource budget – are true, then cuts can be expected elsewhere.

This might explain reports of senior cabinet ministers in “unprotected” departments continuing to hold out in negotiations with the Treasury in an effort to improve their deals. Last week, it was reported that home secretary Yvette Cooper, energy secretary Ed Miliband and housing secretary Angela Rayner were all yet to come to an agreement, with the latter two supposedly refusing to negotiate with Reeves’ number two, Darren Jones.

The day-to-day funding settlement for Rayner’s department, the Ministry for Housing, Communities and Local Government (MHCLG), could have a major knock-on effect for levels of resourcing in local government and therefore on planning support, something which the whole building sector will have a close eye on.

What can Rayner and Miliband win on affordable homes and retrofit?

Fighting down to the wire over a funding settlement can be a risky business for ministers, who are in danger of having a settlement imposed on them by a Treasury that loses patience. But a bit of belligerence can also pay off.

The Guardian reported last week that Miliband’s centrepiece £13.2bn warm homes plan, a major investment in retrofit of British homes, would not be cut in the spending review, allaying the fears of green groups and many working in the refurbishment sector.

>> Read more: Spending review ‘make or break’ for 1.5 million homes target, influential MP tells Treasury

Exactly what deal Rayner can strike for affordable housing is yet to be seen. While MHCLG could be hit by cuts to its resource budget, it is expected to fare better on capital spending, despite a flurry of concern about potential cuts last week.

uggest Reeves could announce a £25bn Affordable Homes Programme but with the grant spread over 10 years instead of the current five.

The longer programme will be welcome, but on an annual basis the £2.5bn a year in grant would be similar to current grant levels once funding ‘top-ups’ are factored in.

The Financial Times is also reporting Reeves could announce plans to redesignate Homes England as a public financial institution or ‘housing bank’ to make it easier to deliver cheaper finance for housebuilding.

This would enable it to create financial assets through big investments or large scale lending. It is understood to be linked to a decision last October to change the UK’s public debt target by allowing the Treasury to offset some liabilities with government financial assets.

The move would reportedly allow Homes England to deliver more finance to the housing industry and lowering the capital cost for housing developers. The Treasury in recent months has been looking at ways of funding affordable housing without pushing up short term capital borrowing.

Officials have been – under which housing associations receive a higher upfront grant payment to reduce their interest costs but then pay back some or all of the grant over time.

Because the money is repaid, government can class it as an investment rather than as a cost on the public balance sheet.

Florence Eshalomi, chair of the housing, communities and local government committee, wrote to the chancellor last week describing the spending review as “make or break” for the government’s 1.5 million new homes target. This is an opinion shared across the housebuilding and social housing sector, which has expressed concern over the past year about the stagnating market for affordable homes.

The National Housing Federation has called for a 10-year Affordable Homes Programme with an average of £4.6bn a year over its first five years (almost double the value of the existing programme), as well as £2bn a year in grant funding for existing social homes and a 10-year rent policy of CPI+1% annually. The sector also has hopes for rent convergence and the reclassification of housing as infrastructure.

Where will the government choose to focus investment?

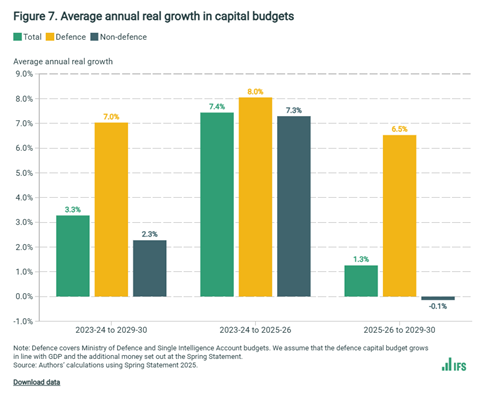

The government’s capital envelope is planned to grow more quickly than day-to-day spending, assisted by Reeves’ decision to change the way government debt is defined. Roughly £113bn of additional investment has been unlocked by this change but, according to the Institute for Fiscal Studies, almost all of the increase in capital spending over the coming years has already been allocated to defence.

The think-tank estimates that capital budgets for non-defence spending will fall by 0.1% a year in real terms between 2025/26 and 2029/30.

This does not mean, of course, that no other department’s investment budget will rise. But it does mean that an increase for one will require a cut elsewhere. If there is a big increase in spending on affordable homes through MHCLG, for instance, that will limit the government’s ability to invest elsewhere.

For instance, while education and health are expected to see big boosts to their resource budgets, there has been less talk about how much they will receive in terms of capital budget. That being said, given the crumbling state of both estates, it would be a difficult decision not to offer some kind of boost to spending in these areas.

Two areas of spending – transport and technology – have already been given major airtime with big, if slightly misleading, funding announcements. Last week, Reeves was advertising plans for a £15bn investment in transport connections outside the South-east, with a raft of rail, tram and bus projects across the north of England, the Midlands and the West Country. There are rumours that tomorrow could see the announcement of a new railway line between Liverpool and Manchester.

But the transport investments teased last week do not account for the Department for Transport’s entire capital budget, and the major announcement of these schemes does not necessarily mean that the department will have its funding increased. It is possible that what we will see will be more of a geographical rearrangement of funding, as a result of changes to the green book formulas.

If reports in The Guardian are to be believed, the mayor of London is unhappy with the Treasury as he is not anticipating any of his favoured transport schemes, which include an extension to the Bakerloo line and the DLR, to be backed in the spending review.

Meanwhile, technology secretary Peter Kyle has boasted of an £86bn boost for R&D. In reality, the annual figure will average £22.5bn, which is only a modest increase on the £20.4bn this year, but the planned spending on life sciences and advanced manufacturing could still have a secondary impact on construction in those sectors.

Those in the infrastructure sector will also likely have an eye on the capital budget for the Department for Environment, Food and Rural Affairs, which will have an impact on investment in climate resilience and adaptation infrastructure.

Sizewell C to get the go-ahead

This one is a sure bet. The chancellor is going to announce at the GMB Congress in Brighton today (Tuesday) a commitment of £14.2bn in funds to build the new nuclear power plant in Suffolk. This was already largely expected.

The joint managing director of the nuclear project in Suffolk told the BBC at the weekend that she was “very optimistic” that the scheme would get final approval this week, while Treasury minister Darren Jones told the Financial Times earlier this year that the final investment decision on the project would be taken at the spending review.

Whether the spending review tomorrow includes any more details on the scheme, or the winners of the competion to design a new fleet of small modular reactors, remains to be seen. Opponents of the Sizewell C project have noted that the announcement today does not mention whether a final investment decision on the scheme has yet been taken.

That could take place tomorrow, although the Financial Times reported this week that the approval might not officially be made until next month, when Keir Starmer and President Macron meet during the Franco-British summit in London between 8 and 10 July. The Sizewell C project is owned by the British government alongside the French state-owned energy company EDF.

Further details to come later in the month

As soon as one budgetary or strategy plan is announced by the government, business turns with baited breath to the next one in the calendar. And so it is this week. Fortunately, they should not have to wait too long this time.

Probably the most significant one will be the long-term infrastructure plan, which is due next week and which will be accompanied by further announcements of specific projects.

The launch of the industrial strategy has been pushed back to the end of June, with the hold up reportedly due to the last-minute spending review negotiations over departmental budgets. The strategy, which was originally slated to be launched in the spring, will address skills shortages in key sectors including life sciences, advanced manufacturing and clean energy.

As much as a big ramp up of investment in key infrastructure and housing will be desired, the certainty given by long-term spending plans will, hopefully, be enough to encourage the private sector.

“Just having that better strategic direction, more stable policy making and certainty of a long-term funding commitment, I think that that will provide a good degree of stability and help mobilise the private sector to not only invest but also help deliver on the infrastructure ambitions the government has,” David Hawkes, head of policy at the Institution of Civil Engineers, told �ǿմ�ý.

That being said, everyone across the sector has their key investment asks, and will have to wait until Reeves steps up to the despatch box at lunchtime tomorrow to find out if their wish has been granted.

�ǿմ�ý’s Funding the Future campaign seeks to examine fresh ways of attracting and using finance to boost construction projects at a time of constrained public finances.

It will examine options for public-private partnerships that can draw on private capital to pay for large infrastructure projects, schools, prisons, hospitals and housing.

It will also look at existing models for private and public funding and examine how these can be optimised to ensure funding is efficiently spent and leads to more shovels in the ground as Keir Starmer looks to construction to boost flagging economic growth.

Over the next few months we will share learning, consult with industry and collect ideas from readers. This will culminate in a special report to be published at our �ǿմ�ý the Future Live Conference in London on 2 October - click here to book your tickets now.

To share your ideas of new funding models, email carl.brown@assemblemediagroup.co.uk. To find the campaign on social media follow #�ǿմ�ýfundfuture.

No comments yet